Investing cash activities primarily focus on assets and show asset purchases and gains from invested assets. The financing cash activities focus on capital structure financing, showing proceeds from debt and stock issuance as well as cash payments for obligations such as interest and dividends. The income statement presents the revenues, expenses, and profits/losses generated during the reporting period. This is usually considered the most important of the financial statements, since it presents the operating results of an entity.

Equity

A balance sheet might show you have $1,000 in accounts receivable, and your income statement shows you earned $1,000 of revenue. But if your clients haven’t paid you that money yet, you don’t have the cash on hand. So the cash flow statement “corrects” line items—for instance, deducting that $1,000 from your cash on hand, since it’s not yet available to cover your costs. External auditors assess whether a company’s financial statements have been prepared according to standardized accounting rules.

Once you get used to reading financial statements, they can actually be fun. By analyzing your net income and cash flows, and looking at past trends, you’ll start seeing many ways you can experiment with optimizing your financial performance. Nonprofit organizations grant scam and fraud alerts record financial transactions across a similar set of financial statements. However, nonprofit organizations do not have shareholders and do not pay out profits. As a result, they use different financial statements to report their activities, income, and expenses.

The Cost of Debt (And How to Calculate It)

They want to know how much you make, how much you spend, and how responsible your company’s management is with your business finances. This information is a good indicator of whether you’ll be in business long enough to pay off your loan. Most small businesses track their financials only using balance sheets and income statements. But depending on how you do your financial reporting, you may need a third type of statement. Although financial statements provide a wealth of information on a company, they do have limitations.

The Cash Flow Statement

- Unlike the balance sheet, the income statement covers a range of time, generally either a year or a quarter.

- Finally, without properly prepared financial statements, filing your taxes can be a nightmare.

- The income statement illustrates the profitability of a company under accrual accounting rules.

- In some instances, analysts may also look at the total capital of the firm which analyzes liabilities and equity together.

- Net income from the income statement flows into the balance sheet as a change in retained earnings (adjusted for payment of dividends).

- In the example below, ExxonMobil has over $1 billion of net unrecognized income.

After you process all of your financial statements, you can use the information to track your business’s financial health and make smart, informed financial decisions for your company. GAAP stands for Generally Accepted Accounting Principles, which is a set of accounting rules and standards developed by the Financial Accounting Standards Board (FASB) in the United States. These principles provide a framework for financial reporting that ensures consistency, comparability, and transparency in financial statements across different organizations. Generally, a comprehensive analysis of the balance sheet can offer several quick views. In order for the balance sheet to ‘balance,’ assets must equal liabilities plus equity.

The income statement provides an overview of revenues, expenses, net income, and earnings per share international system of units during that time. A company’s balance sheet provides an overview of the company’s assets, liabilities, and shareholders‘ equity at a specific time and date. The date at the top of the balance sheet tells you when this snapshot was taken; this is generally the end of its annual reporting period.

Three Financial Statements

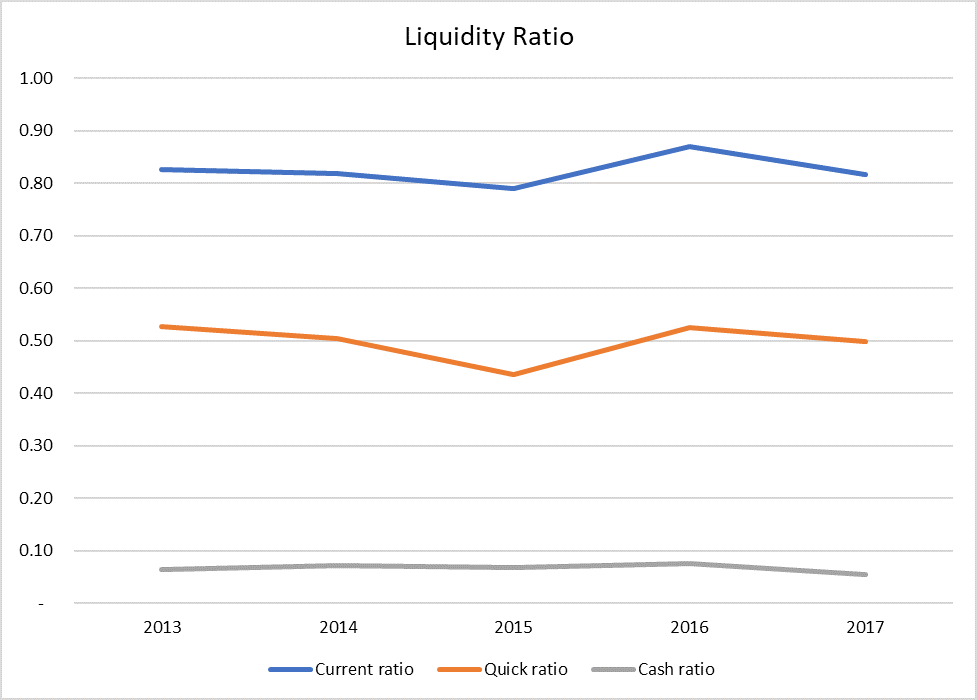

A complete set of financial statements is used to give readers an overview of the financial results and condition of a business. The financial statements are comprised of four basic reports, which are noted below. Learn the correct order to prepare the four essential accounting statements required by GAAP in the field of finance. There are a variety of ratios analysts use to gauge the efficiency of a company’s balance sheet. Some of the most common include asset turnover, the quick ratio, receivables turnover, days to sales, debt to assets, and debt to equity. Lastly, financial statements are only as reliable as the information fed into the reports.

The statements are often interpreted differently, so investors often draw divergent conclusions about a company’s financial performance. Though the accounts listed may vary due to the different nature of a nonprofit organization, the statement is still divided into operating, investing, and financing activities. The cash flow statement reconciles the income statement with the balance sheet in three major business activities. Your business’s financial statements give you a snapshot of the financial health of your company. Without them, you wouldn’t be able to monitor your revenue, project your future finances, or keep your business on track for success. When the financial statements are issued internally, the management team usually only sees the income statement and balance sheet, since these documents are relatively easy what is the difference between to prepare.

The operating portion shows cash received from making sales as part of the company’s operations during that period. It also shows the operating cash outflows that were spent to make those sales. Equity is the remaining value of the company after subtracting liabilities from assets.